Southern Calif Bancorp (BCAL) Reports Q1 Earnings: A Detailed Look

Net Income: Reported $4.9 million for Q1 2024, up from $4.4 million in the previous quarter, but fell short of the estimated $5.47 million.

Earnings Per Share (EPS): Achieved $0.26 per diluted share, below the estimated $0.28.

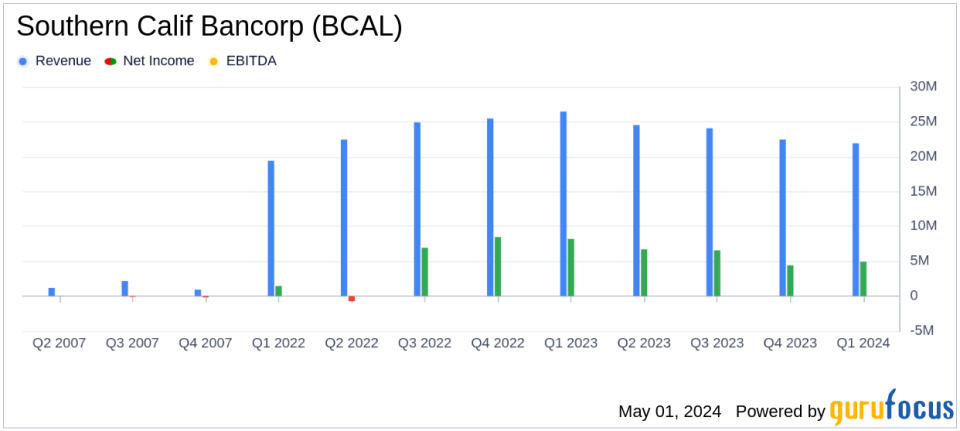

Revenue: Net interest income for Q1 2024 was $20.5 million, indicating a decrease from $22.6 million in the prior quarter and below the estimated $23.42 million.

Loan Portfolio: Total loans held for investment decreased to $1.88 billion at the end of Q1 2024 from $1.96 billion at the end of the previous quarter.

Deposits: Total deposits slightly decreased by $13.0 million to $1.93 billion, with a shift from noninterest-bearing to interest-bearing deposits.

Asset Quality: Non-performing assets increased to 0.84% of total assets, up from 0.55% at the end of the previous quarter.

Merger Expenses: Reported after-tax merger expenses of $547 thousand, which impacted earnings by $0.03 per diluted share.

On April 29, 2024, Southern Calif Bancorp (NASDAQ:BCAL) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company, a cornerstone of banking in Southern California, reported a net income of $4.9 million, or $0.26 per diluted share. These figures fell short of the analyst expectations which estimated earnings per share at $0.28 and a net income of $5.47 million. The reported revenue was $20.5 million, also below the anticipated $23.42 million.

Company Overview

Southern Calif Bancorp, known for its commitment to the business, professional, and personal banking needs of Southern California's dynamic communities, offers a comprehensive range of banking services. These include deposit accounts and financial services catering to individuals, professionals, and small to medium-sized businesses.

Financial Performance Insights

The first quarter of 2024 saw a modest increase in net income to $4.9 million from $4.4 million in the previous quarter. This improvement included $547 thousand in after-tax merger expenses. Excluding these costs, adjusted net income would have been $5.5 million, or $0.29 per diluted share. Despite these gains, the performance marks a decline from the $8.2 million net income reported in the same quarter the previous year.

Chairman and CEO David Rainer commented on the results and future outlook, stating,

Im pleased to report a modest improvement in the Banks quarter-over-quarter earnings and performance metrics... We are excited about our planned merger with California BanCorp, which is expected to be completed later this year, and confident it will create a runway for accretive earnings, with increased efficiencies and the cost savings associated with greater scale."

Operational Highlights and Challenges

The bank's net interest margin decreased to 3.80% from 4.05% in the previous quarter, primarily due to increased funding costs and a lower yield on loans. Total loans, including those held for sale, decreased to $1.89 billion from $1.96 billion at the end of 2023, with significant paydowns reducing the bank's need for wholesale funding.

On the operational front, the bank is navigating a challenging interest rate environment, focusing on maintaining credit quality and managing costs effectively, including a strategic reduction in full-time employee count. The cost of deposits rose to 2.05% from 1.81% in the prior quarter, reflecting the competitive pressure in the banking sector.

Strategic Moves and Future Outlook

Looking ahead, Southern Calif Bancorp is gearing up for its merger with California BanCorp, anticipated to close later this year. This strategic move is expected to bolster the bank's market position by achieving greater scale and operational efficiencies.

The company's balance sheet remains robust with total assets of $2.29 billion, although this is a decrease from $2.36 billion at the end of 2023. The bank continues to exceed the regulatory requirements to be considered well-capitalized, ensuring it is positioned to navigate future economic uncertainties effectively.

As Southern Calif Bancorp navigates through these operational and economic challenges, its focus on strategic growth and maintaining a strong balance sheet will be pivotal in driving future performance and shareholder value.

For detailed financial figures and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Southern Calif Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finanza

Yahoo Finanza